hawaii general excise tax id number

You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO. The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii.

Tax Preperation On Oahu Executive Accounting Solutions

If you have a Hawaii Tax ID you can add tax licenses such as employers withholding transient accommodations cigarette.

. Taxes imposed on business income in Hawaii are the general excise tax. The following Hawaii SalesTax ID numbers are associated with the GE symbol after the states modernization project. Your license certificate will be printed with your Hawaii Tax Identification Number taxpayer name business name DBA if you have one and address.

Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits. Telephone number is leiton. In sales tax related account IDs the letter GE indicates the tax type.

The address is 1225 Honolulu HI 96806-1425. The Hawaii Department of Taxation P. Hawaii Sales Tax IDs have the letters GE beginning the first line and will be followed by 12-digits after the project is completed.

An extension for an additional two 2. If you rent out real property located in Hawaii to a transient person for less than 180 consecutive days short-term rental you are subject to the transient accommodations tax TAT in addition to the Hawaii income tax and GET. A common example would be the GE numeric code.

The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number. Not just the pages but even the text within all the Microsoft Word Excel and Adobe PDF files that we have posted over the years. Here is a sample GE code.

Include this amount in column b on Forms G-45 or G-49 line 19 for Oahu line 21 for Hawaii or line 22. Find resources for Government Residents Business and Visitors on Hawaiigov. Branch licenses are free.

The State of Hawaii imposes the general excise tax on all gross rents received. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET. Individual estimated 02230.

For more information see Tax Facts No. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and conduct other common transactions online with the Hawaiʻi Department of Taxation. The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE.

Amount paid to the lessor and the name and general excise Hawaii Tax ID. For example if you have incorporated your llc you may need a new hawaii tax id number. For online applications an email is sent to you with the general excise identification number within three to five days and after this process you should receive your license within a week.

The license certificate must be displayed at your place of business. AA-123-456-7890-01 Tax type you are paying for tax type code 04610. How Do I Find My Hawaii General Excise Tax Number.

How Do I Find My Hawaii General Excise Tax Number. How Do I Find My Hawaii General Excise Tax Number. ID with sales tax related information such as licenses or IDs have a letter indicating the tax id is GE.

If you have more than one business. Public Service PS 01130. Check out the rest of this guide to find out who needs a General Excise.

A sales tax related ID with a general excise letter is displayed. Number of the lessor. Transient Accommodations TA 05005.

Sales tax IDs issued to Hawaii residents in the wake of the Hawaiis modernization project are unique in their 12-digit letters beginning with GE. Search with Google This custom search allows you to search the entire Department of Taxations Website. General Excise Tax License Search.

Public Service Installment PS 07420. General Excise GE 15095. 3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format.

It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits. Withholding WH 15077.

Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation. Application you will receive your general excise tax license certificate in the mail. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type.

In order for an ID reflecting your sales tax-related account to begin with the letter GE you need to identify the. 2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii. Tax Services Hawaiʻi Tax Online.

GE tax is computed using gross rents not net profit so even if your rental unit is not earning a net profit you still have to pay GE tax. Line 6 If the property is located in a county with a county surcharge subtract the amount on line 5 from the amount on line 1. Examples of these are GE lines.

37-1 General Excise Tax GET and Tax Announcement Nos. 16 Can I add tax licenses to my Hawaii Tax ID. The statewide normal tax rate is 4.

Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. See Hawaii Tax ID Number Changes for more information. Hawaii Tax ID number eg.

If you have more than one DBA complete Form G-50 General Excise Branch License Maintenance Form to get a branch license for each DBA you use. 11 rows If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years. But on Oahu Kauai and the Big Island there is a 05 surcharge.

Is where you should file your general excise and use tax returns.

Filing Hawaii State Tax Things To Know Credit Karma Tax

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals

Licensing Information Department Of Taxation

Council On Revenues Forecasts Jump In Hawaiʻi Tax Revenue Hawai I Public Radio

Hawaii General Excise Tax Everything You Need To Know

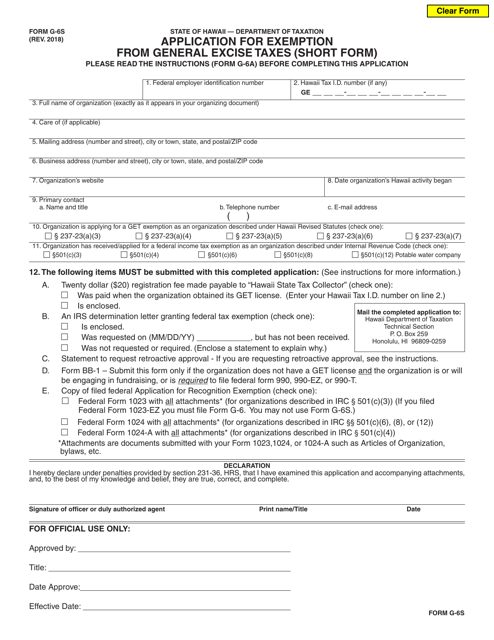

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

Unforgettable Slogans By Indian Freedom Fighters Topperlearning Indian Freedom Fighters Freedom Fighters Indian History Facts

A Fairly Thorough Explanation Of Hawaii General Excise Tax Get For Beginners 2019 Youtube

3d Model Glucose Molecule Molecule Model Website Template Design Molecules

Hawaii General Excise Tax Services Tax Services Oahu

County Surcharge On General Excise And Use Tax Department Of Taxation